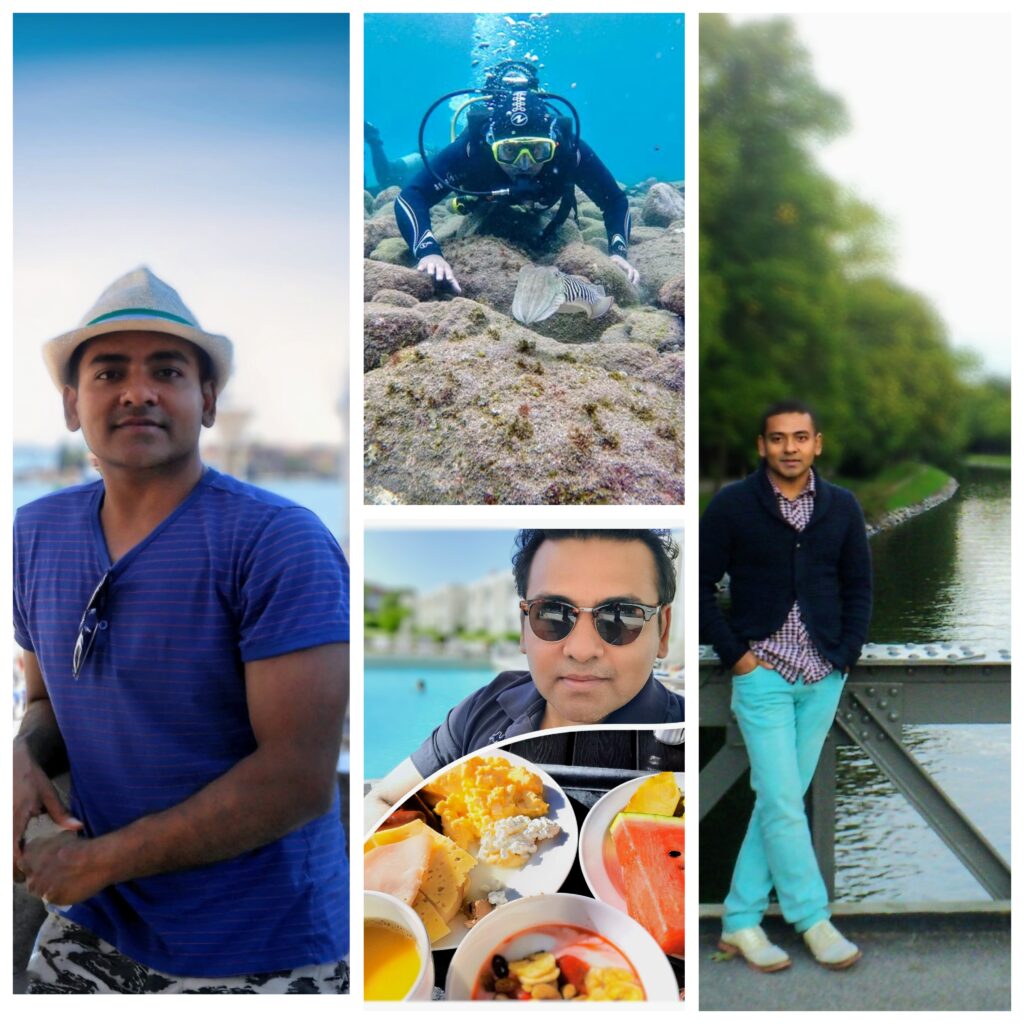

Zakaria Khan

Strategic Intelligence for Leaders Navigating Complexity

I invest, build, and deploy capital at the intersection of emerging technology, global power dynamics, and long-term capital allocation. I provide the strategic intelligence needed to make durable, decade-spanning decisions.

“To understand the forces shaping the future—and help leaders build intelligently within them.”

I spent the early part of my career designing Future Internet Architectures & Protocols, Complex Telecom Systems, Leading Teams & Operations at the EU, Ericsson, and Telenor—building the foundational systems that power modern telecommunications.

I founded Blomstra Ventures to deploy capital and study how complex systems work at scale—from real estate to market cycles to technological disruption. That transition from builder to investor-analyst gave me a unique vantage point.

Today, my primary work is through ventures and private capital — building enduring value across real assets, emerging technology, and macro-driven investments. I selectively advise leaders navigating the convergence of technology, power, and capital.

Builder

EU, Ericsson, Telenor—future internet architecture and protocol design at scale

Investor

Founded Blomstra—real capital deployment, market cycles, property

Strategist

Applying systems thinking to technology, power, and capital

My background in future internet architecture and systems design gave me deep understanding of how complex distributed systems are built at scale. That technical foundation, combined with real capital deployment through property investments and market cycles, created a unique vantage point most strategists lack.

Now I apply that lens to bigger questions: How does innovation reshape power? How should capital be allocated for the long term? What patterns govern technological and political change?

This work sits at the intersection of technology vision, strategic investment, and forward-thinking leadership.

Blomstra Ventures

A privately funded investment mandate focused on long-term capital preservation, strategic asset management, and navigating structural shifts in technology and global order.

Blomstra REIT

Strategic real estate holdings with emphasis on resilient, long-term value in Nordic markets. Building and acquiring assets positioned for demographic shifts.

Blomstra Capital

Macro-driven public market investing informed by cycles, geopolitical trends, and technological disruption. Patient capital deployed across volatile markets.

Blomstra Insights

Research and analysis platform exploring technology, power, and capital. The strategic intelligence engine driving our decisions.

Visit PlatformThe Three Pillars

Proprietary frameworks for understanding how breakthrough technologies reshape competitive dynamics, power structures, and capital allocation strategies.

Innovation & Tech

How breakthrough technologies—AI, network governance, quantum computing—create competitive advantage. Understanding what drives innovation and how organizations can harness it for growth.

Global Power Systems

The changing nature of influence across business, technology, institutions, and global affairs. How leaders position themselves in an era of digital infrastructure, strategic competition, and shifting power structures.

Strategic Capital

Smart investment decisions in an age of disruption. Real assets, public markets, and emerging opportunities analyzed through cycles, macro forces, and technological shifts.

My Strategic Principles

The guiding axioms for decision-making in a complex, non-linear world.

Anti-Fragile Over Optimal

Prioritize systems that gain from disorder (anti-fragile) over those merely optimized for current conditions (efficient but brittle). Efficiency is a tactic; resilience is a strategy.

Capital Always Follows Power

Understand that capital flows are dictated by concentrations of geopolitical or technological power. Investing in technology or regions devoid of long-term power is speculation, not strategy.

The Long Game Requires Real Assets

In an era of currency debasement and technological deflation, tangible, income-producing real assets are the ultimate mechanism for preserving wealth across generations.

Focus on Structural Shifts, Ignore Noise

Ignore the 24-hour news cycle. Identify structural, decade-spanning trends (e.g., the energy transition, the rise of AI, demographic contraction) and position ventures and capital accordingly.

Strategic Reports

In-depth strategic briefings for executives and policymakers navigating complexity.

Innovation & Power: The Next Decade

Comprehensive analysis of how breakthrough technologies will reshape competitive dynamics over the next ten years. Frameworks for executives navigating disruption.

Request Access →Digital Sovereignty: A Strategic Framework

Practical frameworks for understanding infrastructure control, data governance, and technological independence in an interconnected world.

Request Access →Resilient Capital: Investing Through Disruption

Capital allocation strategies for an era of accelerating change. Building wealth through technological shifts and geopolitical turbulence.

Request Access →Featured Analysis & Case Studies

Strategic thinking tested in the real world—not theory, but lived experience.

Navigating a Multi-Year Real Estate Dispute

How strategic clarity and systems analysis prevailed in a complex legal conflict over hotel real estate. Lessons on leverage, institutions, and fighting intelligently.

Read Case Study →My Options Trading Catastrophe

A transparent account of losing significant capital on options—what went wrong, why smart people make this mistake, and how it reshaped my investment philosophy toward patient capital.

Read the Hard Lesson →Strategic Briefings & Keynotes

Strategic Advisory

I work with a select number of organizations each year on long-term strategy, navigating the converging dynamics of technology, power, and capital.

Not tactical consulting—strategic thinking and anti-fragile capital strategies for leaders who operate in decades.

Decade Strategy & Foresight

Multi-year planning for technological shifts, competitive landscape changes, and resource dependency.

Global Power Structure Analysis

Assessing organizational vulnerability across geopolitical conflicts, technological dependencies, regulatory shifts, and competitive positioning. Understanding where power concentrates and how it flows, to convert insight into strategic advantage.

Private Capital Allocation

Guidance for family offices and institutions on structuring wealth for resilience, inflation hedging, and accessing real assets.

Signature Topics

Innovation Strategy for Executives

How to identify, evaluate, and harness breakthrough technologies before competitors do. From AI to quantum to biotech—what executives must understand now.

Power Dynamics in Business

Understanding leverage in the modern economy. Platform power, network effects, and strategic positioning in an age of digital infrastructure.

The Future of Digital Infrastructure

Why semiconductors, data centers, and networks are the battleground of the 2020s. Strategic implications for nations and corporations.

Capital Allocation in Disruption

How smart investors navigate technological change, economic cycles, and geopolitical shifts. Building resilient wealth over decades.

Connect & Collaborate

I work with a select number of organizations annually on questions of long-term strategy and anti-fragile capital allocation.

Not tactical consulting—strategic thinking for leaders who operate in decades.

→ Who Engages Me

→ How We Work Together

Strategic Advisory

Multi-month engagements on technology strategy, geopolitical positioning, and capital allocation. Deep work, not surface-level consulting.

Keynote Speaking

High-impact talks for investor conferences and executive teams. Strategic briefings that change how leaders think about their industries.

Research Partnerships

Collaborative research with think tanks and institutions on strategic questions at the intersection of technology, power, and capital.